Square.com is a leading financial technology company that provides businesses with powerful tools for payment processing, point-of-sale systems, and financial management. Founded in 2009, Square has grown into a comprehensive platform that helps businesses of all sizes accept payments, manage inventory, and streamline operations.

At Square.com, merchants can access a variety of services, including in-person and online payment processing, invoicing, payroll, and business financing. The platform is known for its user-friendly interface, transparent pricing, and seamless integrations with other business tools. Whether you’re a small retail store, a restaurant, or an online business, Square.com offers flexible solutions to simplify transactions and improve efficiency.

With secure payment processing, industry-leading hardware, and software solutions tailored for different business needs, Square.com continues to be a trusted choice for entrepreneurs and established businesses alike.

Table of Contents

Ease of Use

One of the biggest advantages of Square.com is its user-friendly design. Whether you’re a small business owner, a freelancer, or running a retail store, Square makes it easy to accept payments and manage transactions without a steep learning curve.

Setting up an account on Square.com is straightforward, requiring just a few steps before you can start processing payments. The dashboard is intuitive, allowing users to track sales, manage inventory, and access reports with ease.

Square’s mobile app and POS systems are designed for simplicity, making it easy to process in-person payments with just a few taps. Even those without technical expertise can navigate the system effortlessly. Plus, the drag-and-drop website builder for online stores ensures that businesses can set up their digital presence without any coding knowledge.

Overall, Square.com prioritizes ease of use, ensuring that businesses of all sizes can quickly adopt its tools and start accepting payments with minimal hassle.

Pricing and Fees

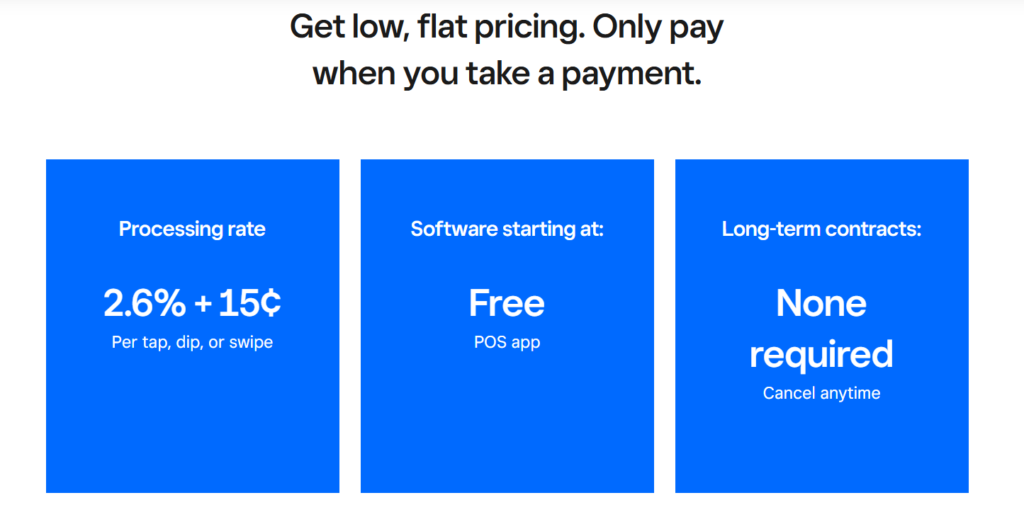

One of the most important factors to consider when choosing a payment processor is cost. Square.com offers transparent pricing with no long-term contracts or hidden fees, making it a popular choice for small businesses and entrepreneurs.

Transaction Fees

Square.com charges a flat-rate pricing model, meaning businesses pay a fixed percentage per transaction. Here’s a breakdown of the standard fees:

- In-Person Transactions (using Square’s POS or card readers): 2.6% + 10¢ per transaction

- Online Transactions (via Square Online or payment links): 2.9% + 30¢ per transaction

- Manually Entered Payments (keyed-in transactions): 3.5% + 15¢ per transaction

Subscription Plans

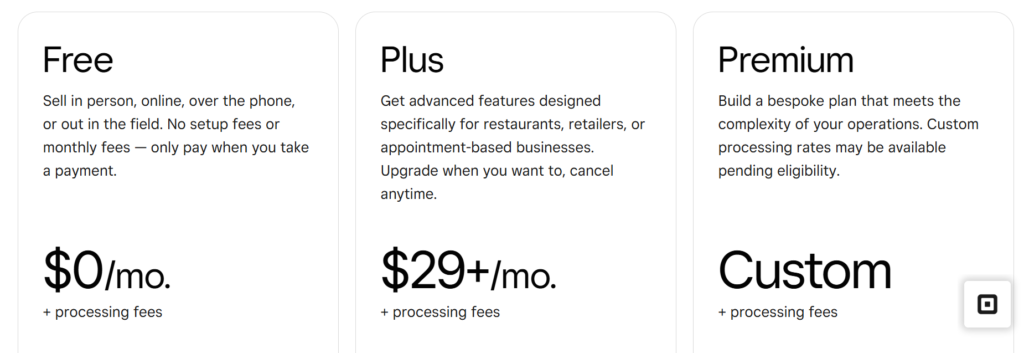

While Square.com provides free access to its basic tools, some businesses may need additional features available in its paid plans:

- Square for Restaurants & Retail – Starts at $60/month per location

- Square Appointments – Free for individuals, $29–$69/month for teams

- Square Payroll – $35/month + $6 per employee

Additional Costs

- Chargeback Fees – Square does not charge a fee for chargebacks, but disputes can take time to resolve.

- Instant Transfers – Standard bank deposits take 1–2 business days, but instant transfers cost 1.75% per transfer.

- Custom Pricing – Large businesses processing high volumes may qualify for custom pricing and discounts.

Is Square.com Worth It?

Square.com’s pricing structure is ideal for small businesses looking for predictable costs without monthly commitments. However, businesses with high transaction volumes might find that traditional merchant accounts with lower interchange rates offer better savings.

By understanding Square.com’s pricing, businesses can determine whether its simplicity and transparency align with their needs.

Payment Processing Features

Square.com offers a comprehensive suite of payment processing features designed to make transactions seamless for businesses of all sizes. Whether you run a brick-and-mortar store, an online shop, or a mobile business, Square provides flexible solutions to accept payments quickly and securely.

Multiple Payment Methods

Square.com supports various payment options, including credit and debit cards, mobile wallets like Apple Pay and Google Pay, and even contactless payments. This flexibility ensures that businesses can cater to a wide range of customer preferences.

Fast and Secure Transactions

With Square’s payment processing, transactions are completed within seconds. The platform uses end-to-end encryption and PCI compliance to protect sensitive customer data, reducing the risk of fraud and chargebacks.

Online and In-Person Payments

Square.com integrates seamlessly with both online and offline sales channels. Businesses can accept payments through Square’s POS system, eCommerce store, or invoicing tools, providing a unified payment experience.

Instant and Same-Day Deposits

Square offers standard next-business-day deposits, but for businesses needing quicker access to funds, Instant and Same-Day Deposit options allow immediate transfers to a linked bank account.

Automatic Payment Tracking

Every transaction processed through Square.com is automatically recorded in the system, helping businesses track sales, manage cash flow, and generate reports with ease.

By offering a secure, fast, and versatile payment processing system, Square.com simplifies transactions for businesses while ensuring a seamless experience for customers.

Hardware Options

Square.com offers a range of hardware options designed to make payment processing seamless for businesses of all sizes. Whether you run a small retail shop, a restaurant, or a mobile service, Square provides affordable and easy-to-use devices that integrate with its payment platform.

Square Reader for Contactless and Chip

This compact and wireless card reader allows businesses to accept chip cards and contactless payments like Apple Pay and Google Pay. It connects via Bluetooth and is perfect for mobile businesses or those with limited counter space.

Square Stand

The Square Stand transforms an iPad into a fully functional point-of-sale (POS) system. It features a swivel design for easy customer interaction and comes with a built-in card reader for seamless transactions. It’s ideal for retail stores and cafes.

Square Terminal

A standalone all-in-one payment device, the Square Terminal lets businesses accept chip cards, magstripe, and contactless payments without the need for additional hardware. It also prints receipts, making it a great choice for restaurants and service-based businesses.

Square Register

For businesses looking for a complete POS system, the Square Register is a fully integrated, dual-screen system. It comes with built-in payment processing, eliminating the need for external devices. This option is best suited for high-volume businesses that need a reliable and professional checkout solution.

Square Tap to Pay

For businesses that want a hardware-free solution, Square offers Tap to Pay on compatible smartphones. This allows businesses to accept contactless payments without any additional equipment, making it a cost-effective and convenient option.

Which Hardware Option is Right for You?

Choosing the right Square.com hardware depends on your business type and needs. For mobile businesses, the Square Reader is a great fit. For brick-and-mortar stores, the Square Stand or Register offers a complete checkout experience. For those who want an all-in-one solution, the Square Terminal provides versatility and ease of use.

With its diverse hardware options, Square.com ensures that businesses of all sizes have the tools they need to process payments efficiently.

Software & Integrations

Square.com offers a robust suite of software solutions designed to streamline business operations. Whether you’re managing a brick-and-mortar store or running an online business, Square’s software provides essential tools for payment processing, sales tracking, and customer management.

Built-in Software Features

Square.com includes a variety of built-in software solutions that help businesses operate efficiently. Some key features include:

- Point-of-Sale (POS) System – Square’s POS software is intuitive and works seamlessly with its hardware, enabling businesses to accept payments, track sales, and manage inventory.

- Square Dashboard – A centralized hub where users can monitor sales, manage customer data, and generate reports.

- Square Invoices – A simple invoicing tool that allows businesses to send and track payments online.

- Square Online Store – A fully integrated eCommerce platform that lets businesses sell products and services online with built-in payment processing.

Third-Party Integrations

Square.com supports a wide range of third-party integrations, allowing businesses to connect their existing tools with Square’s ecosystem. Some popular integrations include:

- ECommerce Platforms – Shopify, WooCommerce, BigCommerce, and Wix.

- Accounting Software – QuickBooks, Xero, and FreshBooks for streamlined financial management.

- Marketing & CRM Tools – Mailchimp, HubSpot, and Zoho CRM to enhance customer engagement.

- Appointment Scheduling – Acuity Scheduling and Square Appointments for service-based businesses.

Why Integrations Matter

By integrating with popular business tools, Square.com ensures that businesses can customize their operations without switching platforms. These integrations help improve efficiency, automate tasks, and create a seamless workflow.

Square.com continues to expand its software offerings, making it a powerful solution for businesses looking for an all-in-one payment and management system.

Business Types & Use Cases

Square.com is a versatile payment processing platform designed to serve a wide range of businesses. Whether you run a small retail store, a bustling restaurant, or a service-based business, Square provides the tools needed to accept payments and manage operations efficiently.

Retail Stores

Square.com is a popular choice for retail businesses, offering point-of-sale (POS) systems, inventory management, and eCommerce integrations. Businesses can process in-person and online payments seamlessly while tracking sales in real time.

Restaurants & Cafés

With features like table-side ordering, digital receipts, and kitchen display integrations, Square is well-suited for restaurants, food trucks, and cafés. The platform’s restaurant POS system helps streamline orders, track ingredients, and manage employees effortlessly.

Service-Based Businesses

Freelancers, consultants, and service providers benefit from Square’s invoicing, appointment scheduling, and mobile payment solutions. Whether you run a salon, repair service, or fitness studio, Square.com makes it easy to accept payments from anywhere.

Ecommerce & Online Businesses

Square offers an all-in-one online store builder and integrates with platforms like WooCommerce and Shopify. Businesses selling digital or physical products can accept payments online while syncing inventory with in-person sales.

Nonprofits & Charities

Organizations can use Square to accept donations, sell merchandise, and manage fundraising events. Square’s reporting features help nonprofits track contributions and generate financial reports effortlessly.

Square.com provides flexible solutions for businesses of all sizes, making it a reliable choice for accepting payments and managing operations.

Customer Support & Reliability

When choosing a payment processing solution, customer support and reliability are critical factors. Square.com stands out as a trusted platform that ensures businesses receive both dependable service and strong customer support.

24/7 Customer Support

Square.com offers multiple support channels, including phone, email, and live chat, ensuring that merchants get help whenever they need it. The platform also provides an extensive help center with FAQs, guides, and community forums to assist users in troubleshooting common issues.

Reliable Payment Processing

One of the key strengths of Square.com is its reliability. The platform boasts a high uptime rate, ensuring that businesses can process payments without interruptions. Transactions are securely encrypted, and the system is designed to handle peak volumes efficiently.

Fast Issue Resolution

Square’s support team is known for quick response times, especially for critical issues. Whether it’s a dispute, a transaction hold, or a technical problem, the support team prioritizes resolving issues swiftly to minimize disruptions to business operations.

Transparent Communication

Unlike some payment processors, Square.com maintains transparency regarding fees, policies, and system status. In case of maintenance or unexpected downtime, the company provides real-time updates to keep users informed.

Trust & Security

Security is a major concern for any payment processor, and Square.com takes it seriously. With advanced fraud detection tools and secure payment encryption, businesses can trust that their transactions and customer data remain protected.

Security & Compliance

Security and compliance are critical factors when choosing a payment processing platform. Square.com provides robust security measures and compliance protocols to ensure safe and secure transactions for businesses of all sizes.

How Square.com Ensures Security

1. End-to-End Encryption

Every transaction processed through Square.com is encrypted from start to finish, protecting sensitive customer information from potential breaches.

2. PCI Compliance

Square.com is PCI-DSS (Payment Card Industry Data Security Standard) Level 1 compliant, meaning it meets the highest security standards for processing card payments.

3. Fraud Prevention Measures

Square.com uses advanced machine learning and AI-driven algorithms to detect and prevent fraudulent transactions before they occur.

4. Two-Factor Authentication (2FA)

To enhance account security, Square.com offers two-factor authentication, adding an extra layer of protection for business owners and employees.

5. Tokenization Technology

Rather than storing credit card details, Square.com replaces sensitive data with a unique token, minimizing the risk of data breaches.

Compliance Standards Met by Square.com

1. GDPR Compliance

For businesses operating in the EU, Square.com ensures compliance with the General Data Protection Regulation (GDPR), safeguarding customer data and privacy.

2. HIPAA Compliance

Healthcare businesses that need to process payments securely can rely on Square.com, which provides HIPAA-compliant solutions for handling patient data.

3. SOC 2 Certification

Square.com meets SOC 2 compliance standards, ensuring strong internal controls for data security and privacy.

Why Security & Compliance Matter

Failing to comply with security regulations can lead to hefty fines, data breaches, and loss of customer trust. With Square.com, businesses can process payments confidently, knowing they are using a secure and compliant platform.

Pros & Cons

Square.com is a popular payment processing platform that offers various financial and business management solutions. It is widely used by small businesses, entrepreneurs, and retailers. However, like any service, it comes with advantages and disadvantages.

Pros of Square.com

1. Easy to Use

Square.com provides a user-friendly interface, making it simple for businesses to set up and process payments quickly. The intuitive design ensures smooth navigation for users of all experience levels.

2. Transparent Pricing

Square.com has a straightforward pricing structure with no hidden fees. The flat-rate pricing model allows businesses to predict costs accurately without worrying about unexpected charges.

3. Free Point-of-Sale (POS) System

Square.com offers a free POS system, which includes software for processing transactions, inventory management, and sales analytics. This is beneficial for small businesses that need an all-in-one solution.

4. Versatile Payment Options

With Square.com, businesses can accept various payment methods, including credit and debit cards, digital wallets (Apple Pay, Google Pay), and contactless payments. This flexibility enhances customer convenience.

5. No Long-Term Contracts

Unlike traditional payment processors, Square.com does not require long-term contracts. Businesses can use the service as needed without being locked into commitments.

6. Business Management Tools

Square.com provides additional tools such as payroll services, invoicing, customer relationship management (CRM), and online store integration, making it a comprehensive solution for businesses.

Cons of Square.com

1. Transaction Fees

While Square.com offers transparent pricing, its transaction fees can be higher than traditional merchant account providers, especially for businesses with high sales volumes.

2. Account Stability Issues

Square.com has been known to freeze or suspend accounts without prior notice if transactions are flagged as suspicious. This can disrupt business operations and delay access to funds.

3. Limited Customer Support

Customer support is primarily available through chat and email, with limited phone support. Businesses that require immediate assistance may find this frustrating.

4. Not Ideal for High-Volume Businesses

Square.com is best suited for small to medium-sized businesses. Larger businesses with higher transaction volumes may find better rates and support with other payment processors.

5. Internet Dependency

Since Square.com relies on internet connectivity for payment processing, businesses operating in areas with poor network coverage may experience disruptions.

6. Chargeback Risks

Like all payment processors, Square.com has chargeback policies that may favor customers. Businesses may find it challenging to dispute fraudulent chargebacks.

Conclusion

Square.com is a powerful and convenient payment processing solution for small businesses. It offers ease of use, transparency, and valuable business tools. However, it may not be the best choice for high-volume businesses due to transaction fees and account stability concerns. Before choosing Square.com, businesses should evaluate their specific needs and compare alternative options.

Ultimately, Square.com is an excellent choice for startups and small businesses looking for a cost-effective, all-in-one payment processing solution. By understanding its strengths and limitations, businesses can make an informed decision that aligns with their goals and operational requirements.